When the House Prices Are Going Down When Will Housing Prices Drop Again

What's the outlook for the Australian property markets for 2022 and beyond?

This is a common question people are request now that the housing market has transitioned from an upswing generally characterised by a strong and wide-based rise beyond the regions of Australia, to ane best described as multi-speed.

At one end of the spectrum are Australia's two largest cities, Sydney and Melbourne are recording flat to falling housing values, while at the other is Brisbane and Adelaide, where the quarterly pace of growth continues to ascent at an annualised pace of more than 20%.

Source: CoreLogic, May 2d 2022

The full value of Australia's residential property marketplace recently surged to $9.9trillion after growing at the fastest almanac pace on record last year.

Residential property prices rose 23.7 percent through 2021, significant that the commonage value of the wealth of property owners increased by $ii trillion in but i yr alone!

Now I know some potential buyers are asking "How long can this last? Will the property market crash in 2022?"

They must be listening to those perma bears who keep telling anyone who's prepared to listen that the belongings markets are going to crash, but they've made the same predictions year afterward yr and accept been wrong in the past and volition exist incorrect once again this time.

What'due south alee for holding values in 2022?

The last few years have shown usa how difficult it is to forecast belongings trends...but here goes - I'thousand going to share a number of property predictions for 2022.

1. Continued property price growth

Property values will go on rising in 2022, but not everywhere and non to the aforementioned extent as they have over the concluding two year.

Concluding yr was unusual as holding values increased almost everywhere at the fastest almanac pace on record and the full value of residential real estate in Australia grew by almost $2 trillion.

However moving forrad the charge per unit of property price growth will deadening and there are several reasons for this including:

- Affordability issues volition constrain many buyers.

The impetus of low-interest rates allowing borrowers to pay more has worked its style through the arrangement and with belongings values existence twenty- 30% higher than at the beginning of this bike at a time when wages growth has been moderate at best and minimal in existent terms for most Australians, this means that the average home buyer won't have more money in their pocket to pay more for their home. - The pent-up demand is waning.

While there are e'er people wanting to move firm and many delayed their plans over the terminal few years because of Covid, in that location are only and so many buyers and sellers out there and in that location volition be fewer looking to buy in 2022. - FOMO (Fearfulness of Missing Out) has disappeared – buyers are being more cautious and taking their time to make intentional decisions, compare to concluding yr when they took shortcuts to enter the market.

two. Nosotros will experience a two-tier property market place.

In other words, not all locations will go on growing strongly moving forward.

While affordability constraints will limit property price growth in Sydney and Melbourne, the smaller upper-case letter cities are still likely to perform strongly.

Simply more than that within the city capital letter growth will be fragmented - I can see properties located in the inner and heart-band suburbs, particularly in gentrifying locations, significantly outperforming cheaper properties in the outer suburbs.

While the outer suburban and more affordable end of the markets take performed strongly then far, affordability is now becoming an consequence as the locals accept had minimum little wages growth of the time when holding prices have boomed.

In these locations, the residents don't have more money in their pay packet to pay the higher prices the properties are now achieving.

More that, Covid19 has adversely affected low-income earners to a greater extent than middle and high-income earners who are likely to recover their income back to pre-pandemic levels more quickly, while many accept non been hit at all.

And as nosotros start to emerge from our Covid Cocoons in that location will be a flight to quality properties and an increased accent on liveability.

As their priorities change, some buyers volition be willing to pay a lilliputian more for properties with "pandemic appeal" and a little more infinite and security, only it won't be simply the property itself that will need to meet these newly evolved needs – a "liveable" location will play a large part as well.

Those who can afford information technology volition pay a premium for the ability to piece of work, live and play within a xx-minute drive, bicycle ride or walk from domicile.

They volition look for things such as shopping, business services, instruction, customs facilities, recreational and sporting resource, and some jobs all within 20 minutes' reach.

iii. Rents will increase strongly

Australia is experiencing a rental crisis.

Increased rental demand at a time of very depression vacancy rates will see rentals keep to rise throughout 2022.

Then when our international borders reopen this will farther increase need for rental housing.

If you think about information technology...when people initially motility to a land or region, most rent first.

In addition, when foreign students return we'll see increased force per unit area on apartment rents shut to education facilities and in our CBDs.

Yet despite the lack of immigration over the concluding few years, just look at how rentals rose - especially for houses.

And as rising house rentals will create affordability problems for many tenants, flat rentals will also increment in 2022.

4. Migration to Queensland will continue

Freed from the constraints of needing turn to upwardly to a CBD office each solar day, and sick and tired of being locked down in our southern states many Aussies migrated toSouth East Queensland last twelvemonth.

And now that our borders have opened up and because the price differential and the perceived lifestyle benefits it's likely that the northern migration volition continue into 2022.

Add together to this positivity off the back of employment growth and the long term benefits of hosting the Olympics and the extra infrastructure building that will occur, this function of Australia is looking particularly positive.

5.Our economy and employment will remain robust

Our economy will proceed growing and the unemployment charge per unit should fall fifty-fifty though many new jobs will be created equally our economic system improves.

Hither's what the banks say most property prices in 2022

You may remember that at the start of the Covid pandemic economist from Australia'due south 4 big banks predicted our property markets would crash with house prices plummeting anywhere between 10 and 15%.

Of grade they were wrong.

They have once again amended their forecasts with our 4 Big Banks suggesting that involvement rates volition ascent sooner rather than later on cooling our belongings market throughout 2022 and then belongings values volition fall in 2023.

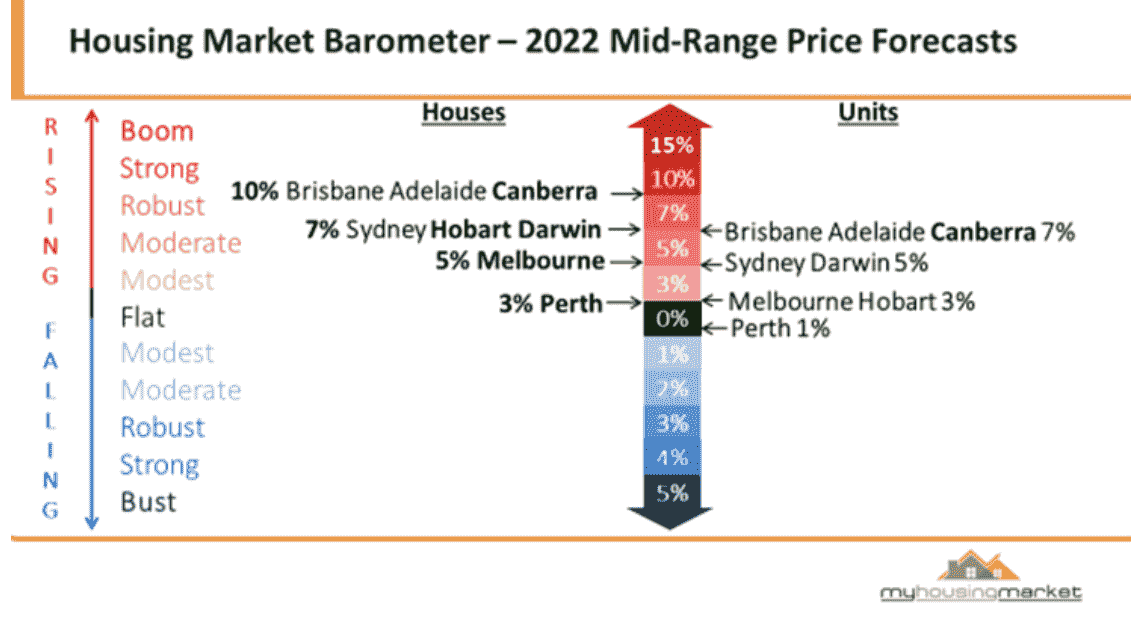

On the other mitt, Dr. Andrew Wilson, Chief Economist of My Housing Market, made the post-obit belongings marketplace forecasts for 2022.

He recently commented that CBA'southward predictions of a potential x% price autumn in 2023 due to rising interest rates were " Simply Ridiculous."

This is what'south been happening to Australian firm prices over the last twelvemonth...

Source: CoreLogic, May 2nd 2022

And so how long volition this cycle go along?

Retrieve the current upturn phase of the property wheel really only commenced in October 2020.

Commonly the upturn stage of the property cycle lasts a number of years and is followed by a shorter boom phase which is eventually cutting short by the RBA raising interest rates or past

Nonetheless, this time around nosotros have experienced an unprecedented rate of growth seeing our holding markets perform even more strongly than anyone e'er expected, with the rates of house price growth at levels non seen for a number of decades.

While a lot has been said about the +20% increase in holding values many locations have enjoyed then far this cycle, it must exist remembered that the last peak for our belongings markets was in 2017 and in many locations housing prices remain stagnant over a subsequent couple of years which ways that average price growth was unexceptional over the long term, averaging out at effectually 5 per cent per annum over the last 5 years .

Now I know some people are worried and wondering "Are the Australian belongings markets going to crash in 2022?"

They hear the perpetual property pessimists who've been chasing headlines and telling everyone who's prepared to heed that the Australian belongings markets are going to crash and housing values could driblet up to 20% - but simply look at the terrible rail records - they've been predicting this every yr for the last decade and they've been incorrect.

Our property markets are merely going to movement out of the sixth gear into 3rd or fourth gear – they are not going into reverse.

What is really holding back the market currently is affordability with house price growth getting well ahead of wages growth.

Now READ: Your Complete Guide to Belongings Investment.

Yet our housing markets merely keep bounding forth...

Source: CoreLogic, May 2d 2022

What's ahead for our belongings markets?

Allow's take a look at a number of property trends that I recall will occur in 2022.

- Property demand from home buyers is going to continue to be strong

Last year when abode prices surged around Australia the media keeps reminding us nosotros're in a property boom.

The upshot was that emotions were running high at the moment, with FOMO (fear of missing out) being a mutual theme around Commonwealth of australia'due south property markets.

At present that overall growth in our belongings markets have slowed (no prices aren't going backwards – growth is simply slowing) in that location are still more buyers in the market for A grade homes and investment grade backdrop than there are properties for sale and this volition underpin habitation values moving forward.

ii. Investors volition squeeze out first home buyers

While there were many first-time buyers (FHB'south) in the market in 2021, buoyed past the many incentives being offered to them, now demand from FHB'southward is fading as property investors re-enter the market and belongings values rise.

Of course over the last few years, investor lending has been low, but with historically low-interest rates and easing lending restrictions, investors are back with a vengeance.

3. Belongings Prices will continue to rise

While many factors affect property values, the main drivers of property price growth are consumer conviction, low-interest rates, economical growth and a favourable supply and demand ratio.

Every bit always, at that place are multiple real manor markets effectually Australia, but in general property values should increment strongly throughout 2022.

However certain segments of the market volition suffer due to affordability issues, as will the city flat towers and accommodation around universities until nosotros get the influx of migrants and international students that the regime is encouraging to render to Australia.

But overall, Commonwealth of australia's depression mortgage rates continue to underpin very strong growth in property prices throughout the country.

4. People volition pay a premium to exist in the right neighbourhood

If Coronavirus taught us anything, information technology was the importance of living in the correct type of holding in the right neighbourhood.

In our new "Covid Normal" world, people volition pay a premium for the ability to work, live and play within a twenty-minute bulldoze, cycle ride or walk from home.

They will look for things such as shopping, business services, education, community facilities, recreational and sporting resources, and some jobs all inside 20 minutes reach.

Residents of these neighbourhoods take now come to appreciate the ability to exist out and most on the street socialising, supporting local businesses, beingness involved with local schools, enjoying local parks.

5. This is a cycle dominated past upgraders

The current property and economic environment, plus the scars left on many of united states after a year of Covid related lockdowns have meant that Aussies are looking to upgrade their lifestyle.

- Many tenants are no longer happy to live in pocket-size dirty apartments and with an crowd of rental units available in many areas, they are taking the opportunity to upgrade their accommodation.

- Other tenants who accept managed to save a deposit are taking advantage of many of the many incentives bachelor and are becoming starting time home buyers.

- With record low-interest rates and surging property markets, many existing homeowners or upgrading their adaptation to larger homes in ameliorate neighbourhoods. In fact, a recent survey suggested that one in iii homeowners are looking to sell their homes in the side by side five years.

- While small-scale group homeowners are upgrading their lifestyle and moving out of the big smoke to regional Commonwealth of australia, more Aussies are looking to upgrade their lifestyle past moving to a better neighbourhood. As mentioned above, they honey the thought that almost of the things needed for a skillful life are only around the corner.

- Many Baby Boomers are looking to upgrade their accommodation by moving out of their old, tired family habitation into large family-friendly apartments or townhouses. But they're not looking for a sea change or tree change, they're corking to live in "20-infinitesimal" neighbourhoods shut to their family and friends.

What nigh the long term prospects for our belongings markets?

Currently, there are about 25.5 million Australians and in early on 2021 the Government released the Intergenerational Report to help Australia and the businesses plan for the next 40 years –.

The IGR projects an Australian population of 38.8 million by 2060-61, and fifty-fifty though this is a little lower than previous projections – due to Covid slowing things down - this still means Australia's population is projected to abound faster than most other developed countries.

Despite the reduction of the projected population, these trends are truly monumental.

If you retrieve near it, it'south taken Commonwealth of australia well over 200 years since European settlement to accomplish a population of 25.5 million people today.

But in the side by side xl years, our population will increase by around 13.3 one thousand thousand people.

In other words, it volition increase by over 50%!

To make this worse, currently, in that location are 2.5 people in each household, merely the IGR forecasts the average number of people in each household will shrink a fiddling moving forward, meaning we are going to require almost a third more existent estate than we currently accept.

To bargain with the projected population growth betwixt now and 2061 information technology'south probable we're going to require i new property built for every 2 properties that currently exists!

All this means our way of living is going to alter considerably and town planners will struggle to cope with this growth.

Of class, this volition impact property investment choices, but strategic, knowledgeable investors will be well-placed to capitalise on the changing trends.

What this means is in that location will be many more than high-rising towers of apartments, non but in the CBD but in our middle-ring suburbs – nosotros are already starting to see that peculiarly in Melbourne and Sydney. And in that location will be lots more than medium-density housing – in particular townhouses will be a popular way to live with modern big adaptation on more compact blocks of land.

It would be foolish to try moving forrard considering no 1 really knows what's going to happen to inflation and involvement rates, merely equally more of u.s.a. want to live in the large capital cities of Australia, and in particular in those locations shut to the CBD or the water where in that location will exist more manatees, the scarcity volition simply push up the price of properties.

What's ahead for our economy?

Despite all its challenges, the Australian economy expanded three.4% qoq in Q4 2021, shifting from a 1.9% fall in Q3.

This was the strongest pace of growth since Q3 2020, mainly boosted by a sharp rebound in household spending equally the economy emerged from COVID-19 lockdowns.

Household consumption bounced back strongly, buoyed by spending on both goods and services with recreation and culture, cafes & restaurants and clothing experiencing stiff rises.

Concurrently, government spending growth eased sharply (0.one% vs iii.eight%); while private investment roughshod for 1st time in vi quarters (-1.iv% vs 0.7%), amid shortages of labor and construction materials.

Also, cyberspace external demand contributed negatively, with exports falling 1.5%, due to mining bolt and travel services; while imports dropped 0.9%, driven past consumption and majuscule goods. On a yearly footing, the economy grew 4.two%, afterwards a 3.9% rise in Q3 and to a higher place consensus of iii.7%.

source: tradingeconomics.com

What about house prices?

Of course, there isn't one Australian belongings market, or 1 Melbourne or Sydney property market so certain segments of the market will outperform.

As opposed to last twelvemonth, moving forward housing market growth volition be more fragmented.

Moving forward some areas volition strongly outperform others.

The coronavirus pandemic has forced all Australians to reevaluate how we live our lives.

Offices were shut, lockdowns were in place, and moving forward people are likely to continue working at home more than ever.

This means gone are the days where our 'home' was only the place we residuum our heads and savor some reanimation between work and our social lives - the coronavirus social distancing has put an end to life equally we once knew it.

If social distancing and the Covid-19 environment have taught us annihilation, information technology has taught us the importance of the neighbourhood we live in.

If you can leave your home and be within walking distance of, or a brusque trip to, a great shopping strip, your favourite coffee shop, civilities, the beach, a great park, the recently implemented coronavirus restrictions might seem a little more palatable than if you lot had none of that on your doorstep.

That's why choosing the right neighbourhood is important for belongings investors?

In brusk, information technology's all to do with uppercase growth, and we all know uppercase growth is disquisitional for investment success, or just to create more than stored wealth in the value of your home.

Sure at that place is always the opportunity to add value through renovating your holding or making a quick buck when ownership well.

But these are off's and won't make a long-term difference if your holding is non in the right location because you lot can't change its location.

This is key because we know that 80% of a property'south performance is dependent on the location and its neighbourhood.

In fact, some locations have even outperformed others by 50-100% over the past decade.

And it'southward likely that moving forward, cheers to the current environs, people will place a greater emphasis on neighbourhood and inner and middle-ring suburbs where more affluent occupants and tenants will be living.

These 'liveable' neighbourhoods with close amenities are where capital growth will outperform.

How do we identify these locations?

What makes some locations more desirable than others?

A lot has to do with the demographics – locations that are gentrifying and likewise locations that are lifestyle locations and destination locations that aspirational and affluent people want to live in will outperform.

It's well known that the rich do not like to travel and they are prepared to and tin afford to pay for the privilege of living in lifestyle suburbs and locations with a loftier walk score– significant they accept easy admission to everything they need.

So lifestyle and destination suburbs where there is a wide range of civilities with 20 minutes walk or drive are probable to outperform in the futurity.

At the same time, many of these suburbs will be undergoing gentrification - these will be suburbs where incomes are growing, which therefore increase people's power to afford, and pay college prices, for holding.

A practiced neighbourhood ways different things to different people, merely at that place are some cardinal factors that help to decide which locations have the potential to abound in value faster in the future.

Generally, a expert neighbourhood is adamant by the physical location, suburb character, and its close proximity to civilities such as a shopping strip, park, coffee shops, instruction, and even some jobs.

It'due south obvious and so that in our new 'Covid' earth, people will desire to exist in a location where everything they need is in short 20-minute proximity - whether that is on public transport, bike ride or walks - to their home.

In planning circles, this concept is known equally the 'xx-minute neighbourhood'.

Many inner suburbs of Australia'southward upper-case letter cities and parts of their middle suburbs already encounter the 20-minute neighbourhood tests, merely very few outer suburbs do because there is a lower developmental density, less diversity in its community, and less admission to public send.

Supply and demand

Rising property prices are the result of 2 basic economic concepts: "Supply and Need" and "Aggrandizement".

All the same, there is a sub-component of Demand, called "Capacity-to-Pay", which is often overlooked.

Understanding how these concepts work together to affect real manor is crucial to one's conventionalities or doubt almost whether existent manor values will rise.

In a free-market economy, prices of any article will tend to drop when supply is high and demand is low.

In other words, when at that place is more than enough of something, it is said to exist a "

Conversely, when supply is depression and demand is high, prices will tend to ascent every bit buyers bid upwards pricing to compete for the limited supply. This is called a "seller's marketplace".

Let's await at it this fashion….

- With regard to supply …. they aren't making whatever more than real estate in the nearly desirable areas and by this, I'm talking about the dirt, not the buildings.

- With regards to demand , Commonwealth of australia has a business organisation plan to increase of population to xl,000,000 people in the adjacent thirty years.

For the last few decades, continued strong population growth has been a key driver supporting our belongings markets.

Australia'southward population was growing by around 360,000 people per annum, meaning we needed to build around 170 to 180,000 new dwellings each year to accommodate all the new households.

Since 60% of our growth is dependent on clearing, in the short-term population growth will autumn, but they should increase once more as soon as overseas immigrants volition exist immune to come to our shores.

Nonetheless, more than and more ex-pats are returning to Commonwealth of australia.

At the same fourth dimension, the number of new properties listed for sale in our capital cities is falling creating an imbalance of supply and demand

Source: Corelogic May 2022

What about affordability?

With property values rising past more than than twenty% in most locations around Australia last year, affordability is starting to bite, particularly in lower socio-economical areas.

But Australian properties have never been cheap - they never have been if you want to live in bang-up locations in major world-form cities.

But at present commencement home buyers are starting to feel the pinch due to the bear upon of high and rising home prices.

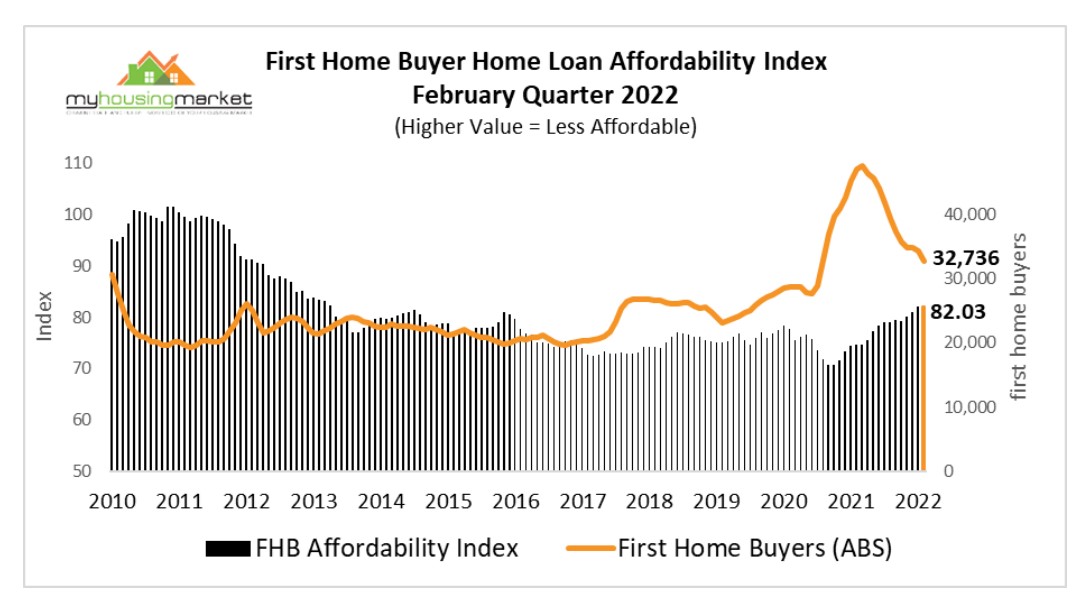

The latest results for the February quarter from theMy Housing Marketplace Beginning Home Heir-apparent Home Loan Affordability Alphabetize however reveal a slight improvement in national affordability.

TheMy Housing Marketplace First Habitation Buyer Home Loan Affordability Index measures the proportion of the average income required for the boilerplate offset home heir-apparent dwelling loan repayment and is derived from ABS statistics.

The college the Index value the less affordable showtime home buyer domicile loan repayments.

The national First Home Heir-apparent Home Loan Affordability Index fell marginally past 0.ii% over the Feb quarter only remained ten.0% higher than recorded over the February quarter of 2021.

Australian house price forecasts

In the medium term, holding values volition exist linked to the extent that our economic recovery affects income, employment, borrowing capacity, and credit availability.

Yet, I'm comfy with the underlying long-term fundamentals supporting our property markets in the medium to long term.

Let's look at a couple of them…

- Population growth

Every bit I said, in the short-term population growth will fall, simply this should increase once again now that the gates have been opened and over 200,000 overseas immigrants will be allowed to come to our shores.

Of class, Commonwealth of australia is likely to be seen every bit one of the safe haven's in the earth moving forward.

- Declining housing supply

The oversupply of dwellings in many Australian locations is now dwindling and in that location are very few new big projects on the drawing board.

Because how long it takes to build new estates or big apartment complexes, nosotros're going to experience an undersupply of well-located properties in our upper-case letter cities in the adjacent year or two.

- Interest rates are depression

The prevailing low-interest-rate environment is making it easier to own a home, either as an owner-occupier or investor.

In fact, it'south never been cheaper for investors to own a property with the "net outlay" – the out-of-pocket expenses – being the lowest they've been for decades considering how cheap finance is today.

- Smaller households are condign the norm

Sure many people live in a multigenerational household, but pretty shortly Millennials will make up one-third of the property market place and their households tend, in general, to be smaller equally are the households of the booming 65+ year one-time demographic.

More than one and 2 people households hateful that moving forward, we will demand more than dwellings for the same number of people.

- More renters

Soon twoscore% of our population will be renters, partly because of affordability bug but also because of lifestyle choices.

The authorities isn't providing accommodation for these people. That's up to you and me as property investors.

- Investors are back in the marketplace with a vengeance.

- The underlying economical fundamentals are strong

- And Australia'southward banking system is strong, stable, and sound.

Even though a few home buyers take overcommitted themselves financially, at that place should be no real concern about household debt because, in general, it is in the hands of those who can afford it.

There is currently a very low rate of mortgage default of mortgage to increase.

Sydney House Toll Forecast

Sydney housing market place weather condition take continued to ease, with housing values posting consecutive months of refuse in Feb and March to be only 0.3% higher over the March quarter.

Ten months ago, Sydney housing values were rising at a quarterly pace of nine.3%.

The weaker atmospheric condition can also be seen in less transactional activity, with our estimates of homes sales down almost 40% compared with the March quarter a year agone, albeit with some probable disruption from the latest moving ridge of COVID and weather-related events on the housing market's activity.

The number of homes bachelor for auction has been trending higher as demand slows and the flow of new listings tracks at to a higher place-boilerplate levels.

At the cease of March, there were 7.v% more homes available for sale than at the same fourth dimension a twelvemonth ago, providing buyers with more than choice and less urgency in their conclusion-making.

However, more investors are getting into the Sydney market at present recognising that while there are no bargains to be plant, in 12 months' fourth dimension the backdrop they purchased today volition await similar a bargain.

Sure in that location are fewer practiced properties for sale at the moment, and many of the good ones are for sale off-marketplace, withal, if you'd like to know a bit more than virtually how to notice these investment gems give the Metropole Sydney squad a telephone call on1300 METROPOLE or click here and leave your details.

Melbourne House Cost Forecast

Melbourne housing values recorded falling 0.ane%, marking the fourth month in a row where housing values take been flat to falling.

The weaker weather condition come up as advertised stock levels rising to be 8% above the previous five-yr boilerplate in March and estimated sales activity reduces to around 9% below the 5-twelvemonth boilerplate.

With higher inventory levels and less competition, buyers are gradually getting some leverage back.

Homes are taking near a week longer to sell compared with final year, vendor discounting rates have picked up a niggling and sale clearance rates have faded to be consistently below the 70% mark.

At Metropole we're finding that strategic investors and homebuyers are still actively looking to upgrade, picking the optics out of the marketplace.

While overall Melbourne property values are likely to increment strongly once again in 2022, like all our capital cities in that location is non one Melbourne property market, and A-form homes and investment-grade properties are likely to outperform.

Sure at that place are fewer skillful backdrop for sale at the moment, and many of the skilful ones are for sale off-market, nonetheless, if you'd similar to know a fleck more about how to find these investment gems give the Metropole Melbourne team a call on1300 METROPOLE or click hither and leave your details.

Brisbane Business firm Price Forecast

Brisbane remains Australia's strongest capital letter city housing marketplace, with housing values ascent 2% over the past month to be virtually 30% college over the past twelvemonth.

Housing values rose two% over the by month - in dollar terms, near $15,000 was added to the Brisbane median value over the month of March.

And fifty-fifty though growth is slowing in other parts of Australia, Brisbane's housing markets is continuing to perform strongly this twelvemonth.

Sure information technology recently suffered from devastating floods, but history shows the resilience of the Brisbane holding market which bounces dorsum apace.

Information technology seems the floods acted every bit a circuit billow for the white hot Brisbane housing market, but our on the ground experience at Metropole Brisbane is that the market is still going going gangbusters.

There just are not enough new backdrop coming onto the market place for sale to satisfy the many home buyers and investors wanting to buy in Brisbane.

Advertised inventory levels remain extremely tight across Brisbane, with total stock levels belongings 42% below the previous five-year boilerplate.

At the same time, abode sales through the March quarter were estimated to be 38% above the five-year average.

Every sub-region of Brisbane has seen housing values rise past more than xx% over the by twelve months, however, it is the coastal markets of South East Queensland where growth has led the state, with housing values surging 32% higher over the year across the Sunshine Declension and 30% higher on the Gold Declension.

The long term outlook for Brisbane'southward housing markets is also looking positive, with a stiff demographic trend fuelled by interstate migration, a large infrastructure upkeep, and a burgeoning level of excitement post-obit the proclamation that Brisbane would host the 2032 Olympic games.

Similarly, popular areas of the Gilt Coast and Sunshine Declension have enjoyed strong demand considering the increased flexibility of existence able to work from home and commuting to the big smoke less frequently.

At the same time, property investor activity has been potent, particularly for houses, not only coming from locals but from interstate investors who see potent upside in Brisbane property prices as well as favourable rental returns.

However, there is not one Queensland belongings marketplace, nor one south-east Queensland property marketplace, and unlike locations are performing differently and are likely to continue to do and so.

Houses remain a firm favourite of prospective home hunters, with demand rise post-lockdown and it remains significantly elevated compared to last year.

However, apartment demand has been sliding and, in general, apartments in Queensland are a higher adventure investment than houses, particularly due to a high supply of apartments that are unsuitable for families or owner-occupiers.

In summary...

Brisbane is likely to be ane of the best performing holding markets over the next few years, simply while some locations in Brisbane have potent growth potential, the right properties in these locations will make nifty long-term investments, certain submarkets should be avoided like the plague.

Now read:Brisbane property markets forecast for string growth

Our Metropole Brisbane squad has noticed a pregnant increase in local consumer confidence with many more homebuyers and investors showing interest in a property.

At the same time we are getting more than enquiries from interstate investors at that place we have for many, many years.

If you'd similar to know a chip more than almost how to find investment course properties in Brisbane please give theMetropole Brisbane team a telephone call on1300 METROPOLEor click hither and get out your details.

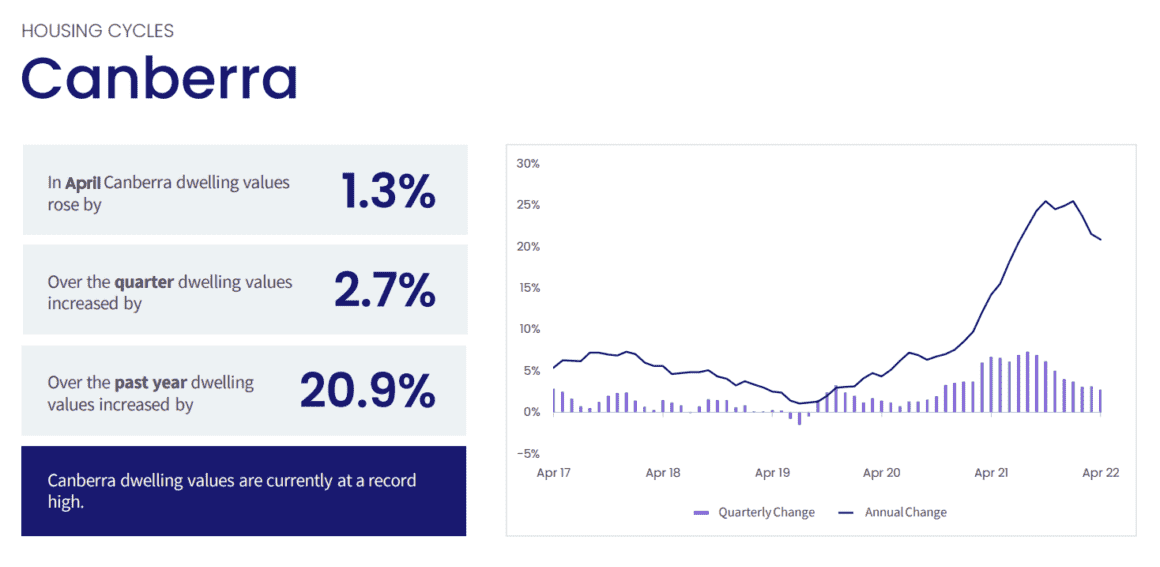

Canberra Firm Price Forecasts

Canberra's property market has been a "serenity achiever" with median house prices recording the biggest leap in prices across all of Commonwealth of australia's majuscule cities, at a huge 25.5% in just one year or 3.7% over the quarter, to a new median of $1.015 million according to Domain's House Price Written report.

That means that prices soared by almost $1,054 a day over the June quarter to give a total rise of $96,000.

This is the steepest price acceleration in nearly three decades, the Domain report explained.

Median house prices in the inner north, inner south, and Woden Valley are now all above seven digits.

Merely unit price growth has been more restrained as the development boom of recent years contains prices, although they are edging closer to a tape high, upwardly a more than modest $18,000 (or 3.half-dozen%) over the June quarter to $504,217.

Interestingly, since the pandemic, Canberra firm prices have risen a huge 30.9% and unit of measurement prices 9.four%, which is the highest rate of growth across all of Australia's cities.

Perth Firm Price Forecast

Perth domicile prices rose just vii per cent in the year to March 31, well behind the national average of 18 per cent, consolidating the long-term trend of under-performance.

The median business firm price in Perth is now the lowest of all capital cities, but 2.2 per cent higher up the pinnacle of $555,781 in June 2014.

Unit of measurement prices have fared even worse and are still xiv per cent less than the loftier of $471,370 in 2013.

The pic is even more stark measured over the by decade, a period when Perth habitation values grew 17 per cent compared with the national average rising of 97 per cent based on figures from PropTrack

Every bit the year progresses I wouldn't be surprised to see an outflow of residents from Western Australia.

Perth's isolation and economical over-reliance on the mining industry means many potential dwelling house buyers would wait at moving away to farther their career.

Gross rental yields in Perth are the highest for all capital cities at 4.ii per cent for houses and 5.5 per cent for units.

But the attractive property prices in Western Australia do not hateful that investors should jump into the Perth property marketplace – there are meliorate opportunities in other parts of Australia.

The problem is the Western Australian economy is too dependent on one industry – the mining industry and much of this is dependent on China, and this has a direct knock-on result on WA business firm prices.

Without structural changes to the W.A. economy, information technology is unlikely to be able to deliver the significant number of college-paying jobs and the substantial increase in population growth required to keep driving strong housing price growth in the medium to long term.

Hobart House Price Forecast

Hobart was the darling of speculative property investors and the best-performing property marketplace in 2017-8, and while dwelling values reached a record loftier in February 2020, its smash was interrupted by Covid-19.

Hobart property values are moving up over again with values upwardly to new record levels of 27.7% over the past year.

Adelaide House Cost Forecast

Adelaide housing values rose another ane.9% in March, taking the median dwelling value to approximately $603,000.

The monthly rise was the second-highest gain of whatsoever capital city, after Brisbane.

1 of the key factors pushing up prices is the ongoing shortage of advertised supply.

Full advertised listings are more than 40% below the previous five-year average, while full sales were estimated to be 53% above the previous v-year boilerplate through the get-go quarter of the yr.

Part of the bewitchery of Adelaide is the relatively depression housing prices.

With a median house value of $740,000 lower relative to Sydney and $340,000 lower than Melbourne.

You may as well be interested in reading:

- What can history teach the states about what's ahead for property

- How to Choose a Property Counselor

- What's alee for Brisbane'south holding market?

- Property Investment In Sydney – twenty Market Insights

- Property Investment In Melbourne – 29 Real Estate Market Tips

Source: https://propertyupdate.com.au/property-predictions-for-2022-revealed/

Post a Comment for "When the House Prices Are Going Down When Will Housing Prices Drop Again"